We’re probably all aware that we should save more for retirement. Fortunately, there is a full spectrum of retirement savings vehicles to choose from. Keep in mind, however, that taxes can have a significant impact on how much of your savings you ultimately get to use once you retire. While taxes play a significant role in our financial well-being, there are ways to optimize our tax strategy to help build wealth over time.

Tax deferral is one such strategy that can have numerous benefits, allowing you to retain more of your income and invest it for growth potential. In this article, we’ll explore the benefits of tax deferral and why it’s a valuable tool to help achieve your financial goals.

What is tax deferral?

Tax deferral is a financial strategy that allows you to delay paying taxes on the gain in certain investments until a later date. Earnings are reinvested so your money compounds over time, potentially offering stronger long-term outcomes than taxable accounts. Retirement accounts such as 401(k)s and IRAs, and investments, such as annuities, take advantage of tax-deferred growth.

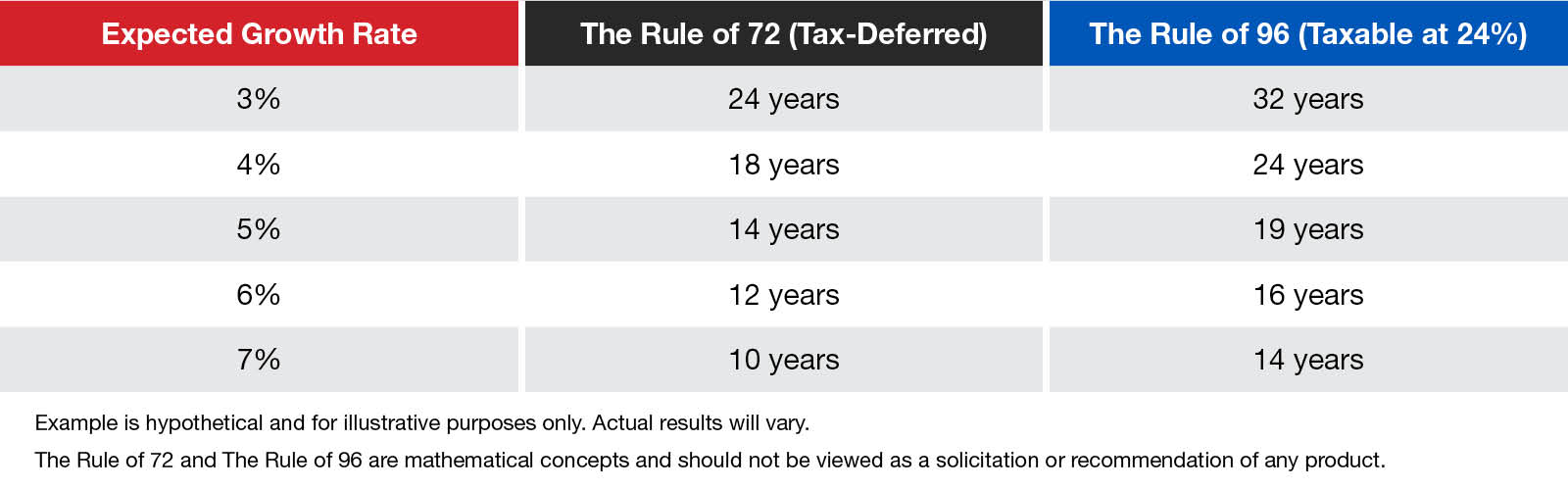

These rules help illustrate the benefits of tax deferral.

The Rule of 72

- The Rule of 72 is used to estimate the number of years required to double money invested in a tax-deferred account at a given annual rate of return.

- To calculate the Rule of 72, you divide 72 by the rate of return of an investment or account.

The Rule of 96

- The Rule of 96 is used to estimate the number of years required to double money invested in a taxable account at a given annual rate of return and an assumed federal tax rate of 24% assessed yearly.

- To calculate the Rule of 96, you divide 96 by the rate of return of an investment or account.

This chart illustrates how each of these rules work using rates from 3% to 7%.

The potential to save more for retirement

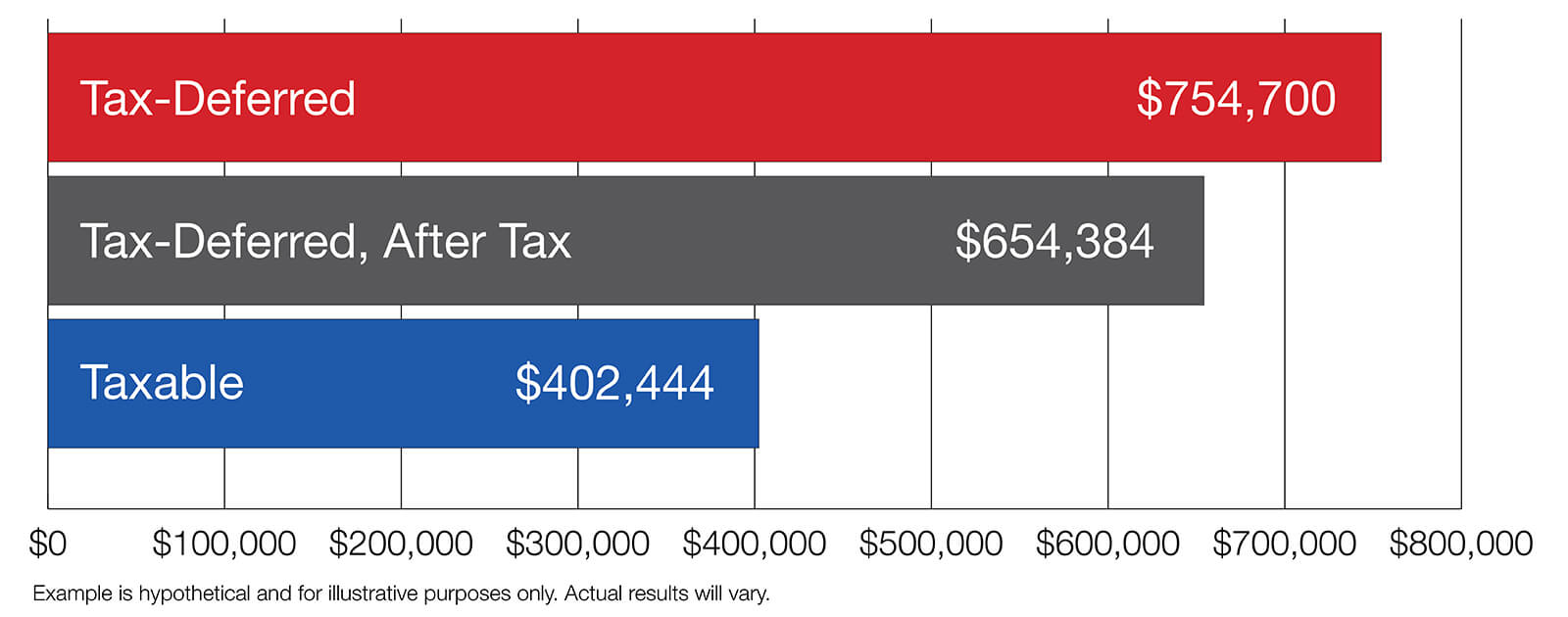

With a tax-deferred strategy, the money that might otherwise go to pay current taxes remains invested for greater long-term growth potential. How much of a difference could that make in the long run?

Look at this hypothetical example to see how powerful tax deferral can be when it compounds over time.

- A single tax-deferred investment earning 8% gross annual interest over 30 years.

- After 30 years, the single investment has grown to more than $750,000.

- When the lump sum is withdrawn, 28% taxes are paid, which means the amount received is around $560,000.1

- A single taxable investment also earning 8% gross annual interest over 30 years with 28% being paid in taxes every year.

- Over the same 30 years, the amount received is about $400,000.

The tax-deferred investment earned approximately $160,000 more than the taxable investment.

Keep in mind, real-life scenarios need to take factors like insurance expenses, annual policy fees or investment option expenses into account. Lower tax rates on capital gains and dividends could make the taxable investment returns more favorable, which would lessen the difference.

Before making an investment, consider your personal investment horizon and income tax rate, both current and anticipated. Changes in tax rates and tax treatment of investment earnings may further impact the results of this comparison.

Take action for your financial future

As you prepare for your financial future, it may make sense to periodically review your retirement savings and investment strategies from a tax perspective:

- Identify tax saving opportunities with your financial and tax professionals. They can be resources for evaluating your tax liabilities and potentially identifying ways of reducing your tax burden in the future.

- Consider how tax-deferred savings or investment strategies may help you reduce current taxes.

- Explore annuities to save for retirement on a tax-deferred basis. Keep in mind, the purchase of an annuity within a retirement plan or account does not provide additional tax-deferred treatment of earnings. However, annuities do provide other features and benefits that may be important to you, including options for guaranteed lifetime income and a guaranteed2 death benefit for your beneficiary.

Ameritas can help

Harnessing the power of tax deferral may help you build wealth and achieve your long-term financial goals with greater ease and efficiency. Learn more about our annuity offerings to see if one is right for your financial strategies.

Sources and References:

1Withdrawals of taxable amounts from tax-deferred investments are subject to ordinary income tax, and if taken prior to age 59½, an additional 10% federal tax may also apply. Withdrawals are also subject to state tax.

2Guarantees are backed by the claims-paying ability of the issuing company.

Neither Ameritas Life Insurance Corp. nor its representatives provide tax or legal advice.

In approved states, annuities are issued by Ameritas Life Insurance Corp. In New York, annuities are issued by Ameritas Life Insurance Corp. of New York.